If you’re a maritime worker who was injured in an on-the-job injury that resulted from the careless actions of a co-worker or employer, the Jones Act and other maritime laws give you the right to seek compensation for the damages caused by your injuries. Depending on the circumstances, you may be able to collect compensation for damages like medical bills, lost wages, pain and suffering, and more.

The Lambert Firm is here to protect your rights to ensure you get the total compensation you deserve for your injuries. We’ve represented workers injured in maritime accidents since the 1970s. Our maritime lawyers have obtained over $1 billion in cash settlements for our clients.

Do I Have to Pay Taxes on the Settlement for My Maritime Injury Claim?

How long it takes to resolve a maritime injury claim depends on many factors. Typically, it takes at least six months to complete the process. The plaintiff receives their cash settlement shortly after an agreement is reached.

“Are maritime injury settlements taxable?” is one of the most common questions we get asked after we’ve secured a client’s settlement. In most cases, the answer is no — maritime injury settlements are not taxable.

What the IRS Has to Say About Whether Maritime Injury Claims Are Taxable

IRS Code § 104 addresses the issue of paying taxes on a maritime injury claim settlement.

Section 104 excludes from gross income the amount of any damages (other than punitive damages) received (whether by suit or agreement and whether as lump sums or as periodic payments) on account of personal physical injuries or physical sickness.

Basically, this means that any money you receive on account of a personal injury is not considered income to you during that year. These laws apply to worker’s compensation (including those made under the Longshoremen and Harbor Workers’ Compensation Act) disability payments as well.

It’s important to note that Section 104 only applies to physical injuries:

“Emotional distress shall not be treated as a physical injury or physical sickness. The preceding sentence shall not apply to an amount of damages not in excess of the amount paid for medical care…attributable to emotional distress.”

This means that if your claim is for emotional distress, depression, or PTSD, maritime injury settlements may be taxable unless it includes damages for physical injuries as well.

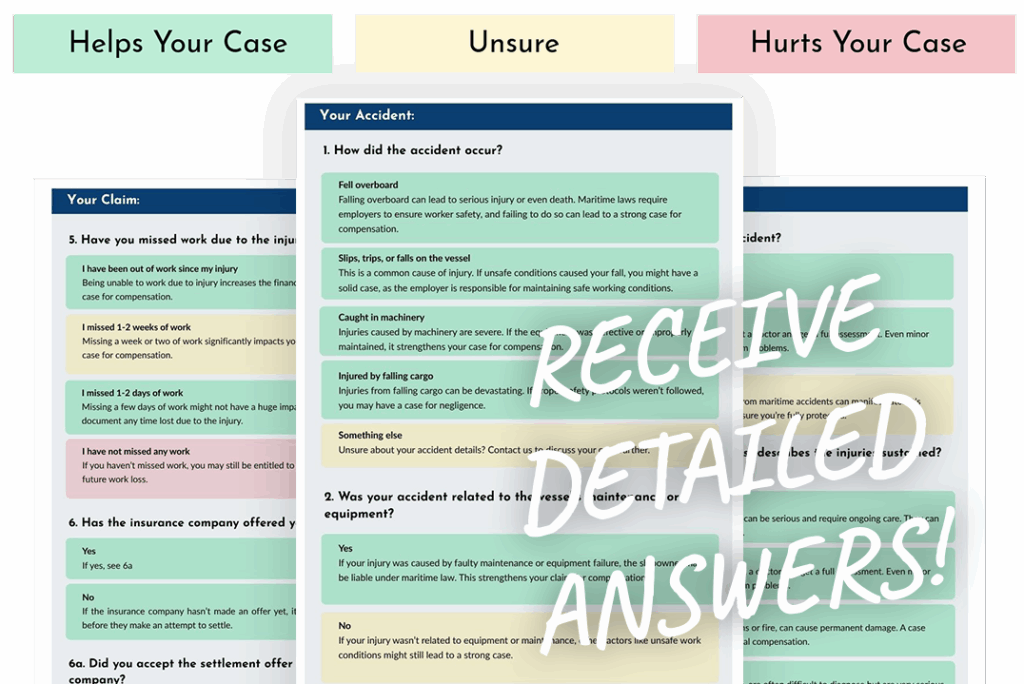

Get Our FREE Guide to Protect Your Claim

What you do after an accident is critical. Insurance companies will try to get you to make mistakes that can hurt your claim. Our free guide can help you avoid these traps.

Download our complimentary guide: “5 Costly Mistakes to Avoid After Any Maritime Accident” to arm yourself with the knowledge you need to protect your rights.

Contact The Lambert Firm If You’ve Been Injured in a Maritime Accident

We don’t have to tell you that maritime work can be hazardous. That’s why it’s so important for maritime employers to do everything they can to maintain a safe workplace for their employees. When they fail to do so, serious, even fatal accidents can occur.

If you’ve been the victim of a maritime accident, get in touch with The Lambert Firm today. You can contact us through our website or call us at 800-521 -1750. We’re available to review your case, answer any legal questions you may have, and provide professional legal advice on the best way to proceed with your claim.

If you’re a maritime worker who was injured in an on-the-job injury that resulted from the careless actions of a co-worker or employer, the Jones Act and other maritime laws give you the right to seek compensation for the damages caused by your injuries. Depending on the circumstances, you may be able to collect compensation for damages like medical bills, lost wages, pain and suffering, and more.

The Lambert Firm is here to protect your rights to ensure you get the total compensation you deserve for your injuries. We’ve represented workers injured in maritime accidents since the 1970s. Our maritime lawyers have obtained over $1 billion in cash settlements for our clients.

Do I Have to Pay Taxes on the Settlement for My Maritime Injury Claim?

How long it takes to resolve a maritime injury claim depends on many factors. Typically, it takes at least six months to complete the process. The plaintiff receives their cash settlement shortly after an agreement is reached.

“Are maritime injury settlements taxable?” is one of the most common questions we get asked after we’ve secured a client’s settlement. In most cases, the answer is no — maritime injury settlements are not taxable.

What the IRS Has to Say About Whether Maritime Injury Claims Are Taxable

IRS Code § 104 addresses the issue of paying taxes on a maritime injury claim settlement.

Section 104 excludes from gross income the amount of any damages (other than punitive damages) received (whether by suit or agreement and whether as lump sums or as periodic payments) on account of personal physical injuries or physical sickness.

Basically, this means that any money you receive on account of a personal injury is not considered income to you during that year. These laws apply to worker’s compensation (including those made under the Longshoremen and Harbor Workers’ Compensation Act) disability payments as well.

It’s important to note that Section 104 only applies to physical injuries:

“Emotional distress shall not be treated as a physical injury or physical sickness. The preceding sentence shall not apply to an amount of damages not in excess of the amount paid for medical care…attributable to emotional distress.”

This means that if your claim is for emotional distress, depression, or PTSD, maritime injury settlements may be taxable unless it includes damages for physical injuries as well.

Get Our FREE Guide to Protect Your Claim

What you do after an accident is critical. Insurance companies will try to get you to make mistakes that can hurt your claim. Our free guide can help you avoid these traps.

Download our complimentary guide: “5 Costly Mistakes to Avoid After Any Maritime Accident” to arm yourself with the knowledge you need to protect your rights.

Contact The Lambert Firm If You’ve Been Injured in a Maritime Accident

We don’t have to tell you that maritime work can be hazardous. That’s why it’s so important for maritime employers to do everything they can to maintain a safe workplace for their employees. When they fail to do so, serious, even fatal accidents can occur.

If you’ve been the victim of a maritime accident, get in touch with The Lambert Firm today. You can contact us through our website or call us at 800-521 -1750. We’re available to review your case, answer any legal questions you may have, and provide professional legal advice on the best way to proceed with your claim.